As Brunei races toward Vision 2035, are we equipping our workforce with the right tools, or are we missing the mark? Despite our ambitions, underemployment, and a preference for foreign talent tell a different story. How can we bridge the gap between education and the realities of our job market? It’s time to rethink our strategies—because a vision without action is just a dream.

Vision 2035 in Focus: Where is Brunei's Workforce Heading?

Brunei's Vision 2035 aims to cultivate a highly educated and skilled workforce, serving as a cornerstone for the nation's long-term development strategy.

However, achieving this vision presents challenges that underline the need for a deeper focus on organizational development, cultural adaptation, and people-centric reform.

An important challenge facing Brunei's workforce is the mismatch between educational outcomes and job market needs.

Despite substantial investments in education, many graduates, including those with advanced degrees, find themselves in underemployed roles that fail to utilize their skills effectively.

This trend emphasizes the importance of aligning educational programs with market demands and fostering a culture of continuous learning and adaptability within organizations.

The Manpower Planning and Employment Council (MPEC), established in 2020 under the Prime Minister's Office, plays a central role in addressing these challenges.

MPEC's mission is to create a productive, sustainable, and competitive workforce by aligning workforce skills with the needs of the economy.

However, this mission needs broader support through organizational development initiatives that promote continuous learning, knowledge enrichment (personally and organizationally), and the cultivation of organizational wisdom. Unfortunately, these elements have yet to be fully realized.

Continuous Learning and Knowledge Enrichment

Continuous learning is essential for developing a workforce that can adapt to the ever-changing demands of the global economy.

Organizations, both public and private, must foster environments that encourage ongoing professional development.

This includes providing access to training programs, offering opportunities for skill enhancement and upgrading, and integrating new technologies and methodologies.

Knowledge enrichment, which involves systematically capturing, sharing, and applying knowledge, should be a priority.

By promoting a culture of learning, continuous improvement, and adaptability, Brunei's organizations can enhance their capacity for innovation and adaptability.

The Challenge of Achieving Organizational Wisdom and Maturity

In conclusion, achieving organizational wisdom and maturity poses a significant challenge for many institutions in Brunei.

To address this, a focus on continuous learning, knowledge enrichment, and the ability to make informed decisions based on experience, knowledge, and insight is crucial.

Additionally, organizational maturity involves sustaining effective operations over time while remaining adaptable to environmental changes.

Unfortunately, many of Brunei's institutions have not fully integrated these elements.

Cultivating a wise and mature organizational culture requires time, commitment, and a willingness to embrace change.

Without these factors, the potential for Brunei's workforce to reach its full potential is limited.

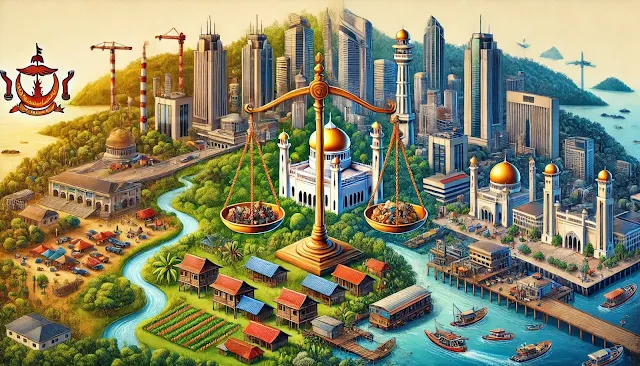

Furthermore, in addition to internal organizational development, the government's administrative reforms, such as privatization, corporatization, and commercialization of government activities and services, play an important role in Brunei's overall economic strategy.

Privatization, like PPP, can increase efficiency, stimulate competition, and improve service delivery.

However, it is essential to carefully manage these reforms to ensure they contribute to job opportunities and positively impact workforce development.

Privatization and corporatization of government-run utilities and services should be accompanied by efforts to enhance organizational knowledge and wisdom, including providing opportunities for local talent to grow within private entities and fostering a culture of continuous improvement and adaptability.

At the heart of these efforts should be a people-centred approach to development. By prioritizing human capital, Brunei can create a more resilient and dynamic workforce.

This approach emphasizes employee engagement, professional growth, and aligning individual aspirations with organizational goals.

Investing in people not only enhances an organization's capacity for success but also contributes to the nation's vision of a prosperous and competitive economy.

As Brunei progresses towards Vision 2035, incorporating organizational development principles will be crucial for overcoming future challenges.

Key elements such as continuous learning, knowledge enrichment, organizational wisdom, maturity, and adaptability need to be implemented.

However, it is essential to recognize that achieving these ideals will require significant progress.

Without a focused effort to cultivate these qualities within organizations, Brunei's workforce may not fully contribute to the nation's development.

Therefore, the government's administrative reforms, including the privatization of corporations, need to align with these goals to ensure the development of a capable workforce that can drive Brunei's economic future.

This balanced approach of lessening the government burden and increasing revenue profitability must go hand in hand with employment opportunities and human resources development.

By adopting a people-centred approach to development, Brunei can come closer to achieving the ambitious goals outlined in Vision 2035.

This will create a future where people are empowered, the economy is dynamic, and organizations are wise and adaptable.

Although these qualities are crucial, they have not yet been fully embraced.

In a Nutshell:

· Brunei's Vision 2035 aims to create a highly educated and skilled workforce, but challenges persist.

· Despite investments in education, many graduates are underemployed, and there's a gap between academic qualifications and job market needs.

· Organizational wisdom, maturity, and adaptability have yet to take root, hindering progress. The government should ensure that its administrative reforms, such as privatization, are in line with workforce development goals.

· To achieve Vision 2035, Brunei needs to prioritize continuous learning, knowledge enrichment, and a people-centred approach within organizations, while also addressing slow economic growth and over-reliance on foreign talent.

.jpeg)