BANDAR SERI BEGAWAN, SEPTEMBER 2024: While Brunei’s retailers are left counting their losses, businesses in neighbouring Sarawak and Sabah are laughing all the way to the bank, thanks to a surge in spending from Bruneians crossing the border.

The latest report from Brunei’s Department of Economic Planning and Statistics (DEPS) paints a sobering picture of falling retail sales, but there’s an elephant in the room that wasn’t addressed: the billion-dollar leak as Bruneians flock to Malaysia for better deals.

In the second quarter of 2024, Brunei’s retail sector experienced a 6.1% drop in sales, with revenue shrinking from BND 446.1 million in Q2 2023 to BND 418.9 million.

Sales volume also fell by 5.9%, signalling a widespread reduction in domestic consumer spending.

Key categories like furniture, household equipment, and electrical appliances were hit hardest, with furniture sales dropping by a staggering 19%.

The DEPS report attributes these declines to reduced consumer demand, but many on the ground believe the real issue goes unmentioned — Brunei’s billion-dollar cross-border shopping habit.

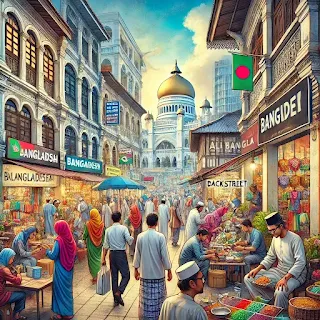

For years, Bruneians have crossed into Miri and Kota Kinabalu in search of better prices and wider product variety.

The favourable exchange rate and lower costs for everything from groceries to clothes have made Malaysia an irresistible shopping destination.

Before the pandemic, Bruneians made over two million trips to Malaysia in 2019, and as restrictions eased, the trend returned in full force. In 2023 alone, 1.57 million trips were made across the border.

Though the DEPS report doesn’t address this directly, the economic impact is undeniable.

Sarawak has been one of the biggest beneficiaries. In January 2024 alone, Sarawak received 350,000 tourists, bringing in RM 900 million in revenue, a large chunk of which came from Bruneians.

As businesses in Miri thrive, Bruneian retailers are struggling to compete. Supermarkets saw a 6.9% drop in sales, while department stores faced a 6.0% decline. For many local shop owners, the cross-border drain is impossible to ignore.

“We just can’t compete with Miri’s prices,” lamented one shopkeeper. “Why would people spend here when they can get the same products for much less in Malaysia?”

The problem isn’t limited to retail alone. Brunei’s food and beverage sector is also feeling the pinch. Revenue fell by 1.0% in Q2 2024 compared to the previous year, with fast food outlets seeing a 3.2% drop and restaurants experiencing a 1.5% decline.

While the DEPS report attributes this to reduced local demand, many Bruneians are opting to dine out in Malaysia, where food is often cheaper and the variety more appealing.

For many Bruneians, cross-border shopping and dining aren’t just about saving money — it’s about access to better quality goods and services.

“The price difference is huge,” says a regular shopper from Brunei.

“I can get everything I need in Miri for a fraction of what I’d pay back home. Why wouldn’t I go?”

This sentiment reflects a broader issue facing Brunei’s retail landscape: the inability to compete with Malaysia on price, variety, and experience.

This cross-border drain is not just an annoyance for local businesses; it poses a serious threat to Brunei’s long-term economic ambitions.

The country’s Wawasan 2035 vision aims to diversify the economy and reduce reliance on oil and gas, but the outflow of billions in consumer spending to Malaysia is undermining these efforts.

A recent policy brief by Associate Professor Dr Khalid Ahmed from the Institute of Policy Studies at Universiti Brunei Darussalam, titled "Cross-Border Cash Drain," estimates that Brunei is losing over BND 1 billion annually due to cross-border shopping.

That’s BND 1 billion that could be circulating within Brunei’s economy, supporting local businesses and creating jobs. Instead, it’s filling the pockets of retailers in Sarawak and Sabah, leaving Brunei to wonder how it can stem the tide.

As Sarawak’s economy booms — with its tourism industry employing nearly 20% of its population — Brunei’s businesses are left asking how they can keep their customers at home.

Without intervention, the cross-border leak will continue to threaten the country’s economic stability, particularly as it strives to diversify and grow beyond its reliance on oil and gas.

So what can be done?

Some experts believe that lowering shop rents and introducing incentives for local businesses could help make Brunei more competitive.

Others suggest that expanding the variety of goods and services available locally is key to keeping Bruneians from crossing the border.

“It’s not just about price,” says one economic analyst. “Bruneians want options. If we can’t offer them that, we’ll keep losing customers to Malaysia.”

At the heart of the issue is the question of national pride and economic self-reliance.

As Brunei pushes towards Wawasan 2035, supporting local businesses has never been more important. Yet, the allure of cheaper prices and more choices across the border remains strong, pulling Bruneians away from their markets.

In the end, the billion-dollar question is this: can Brunei plug the leak?

As retailers struggle and cross-border spending continues to rise, the future of the country’s economy could depend on how quickly and effectively this issue is addressed.

The next few quarters will be crucial in determining whether Brunei can find a way to reinvigorate its retail sector and keep its wealth at home or whether its neighbours will continue to prosper at its expense. (MHO/09/2024)

.jpeg)